Understanding the Basics of Tax Lien Investing

Many of the topics related to tax lien certificates are covered in the real estate education courses that prospective realtors have to complete and be evaluated on before getting their professional licenses. Investing in tax liens is only possible because of statutes, rules, and legal processes enabled by revenue collection agencies at the county level.

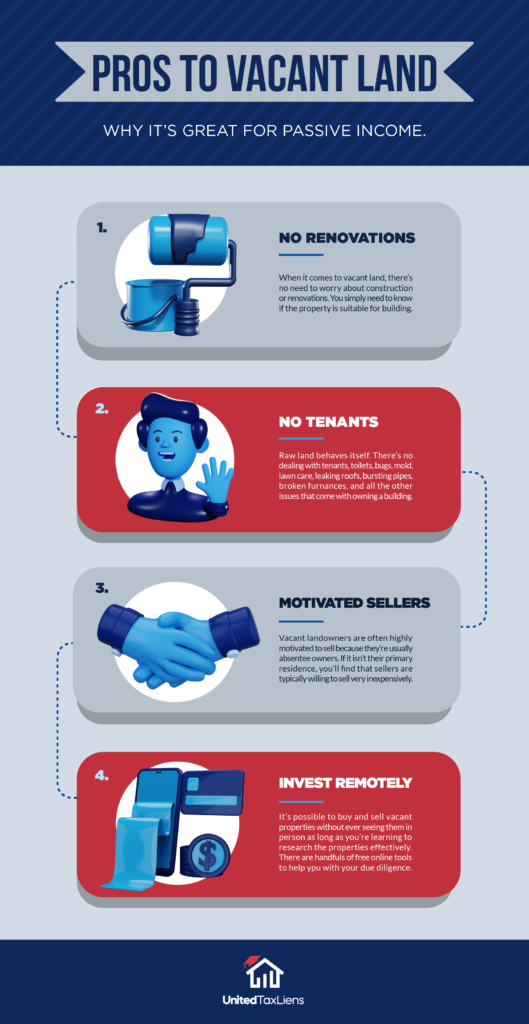

At its most basic level, tax lien investing consists of purchasing outstanding debt in the form of certificates issued by revenue collection and management agencies. The debtors are property owners who have fallen behind on paying taxes; the properties can be residential structures or plots of land.

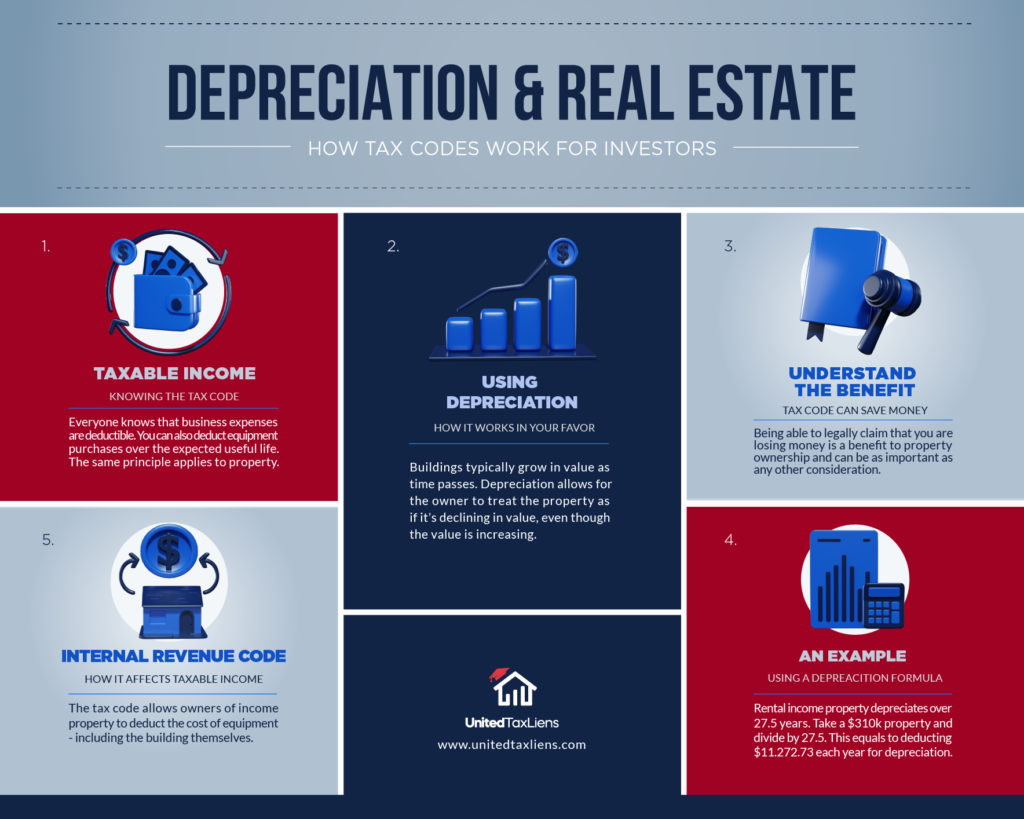

If a property owner refuses to pay their taxes, the county will place a tax lien certificate on the property. Investors often purchase tax lien certificates because they are backed by real estate collateral. In many states, the county allows the certificate holder to take ownership of the property through tax lien foreclosure. Prospective investors need to understand that acquiring a certificate means paying off debt owed to a municipal entity, which means that they are bailing out an agency by providing them with the cash needed to manage their budgets. The delinquent property owners are not bailed out because they are not off the hook yet; they must repay the investor in the form of back taxes, fees, and interest accrued.

A tax lien certificate can be thought of as being similar to a municipal bond in the sense that you know the investment is legitimate under its issuance. If the process of auctioning off outstanding tax debt was not legal, revenue collection agencies would not be able to conduct it. Unlike bonds, investors will not get interest payments from the issuer; they are supposed to collect it from the property owner over a period stipulated by law. This is known as idle tax lien investing. Let's say a homeowner in Arizona owes about $2,000 in unpaid property taxes plus penalties that result in a lien being filed and a certificate auctioned off. An investor holding the certificate can legally get $2,000 back from the homeowner plus the interest indicated at auction; if this repayment is completed within the term, the debt obligation is satisfied and recorded by the county clerk. Should the homeowner not be able or refuse to pay the investor, the certificate can be redeemed in the form of a legal right to foreclosure, which presents an opportunity to being named on the deed and acquiring some level of property ownership; we cannot say full ownership because there may be claims to title and other liens to clear.

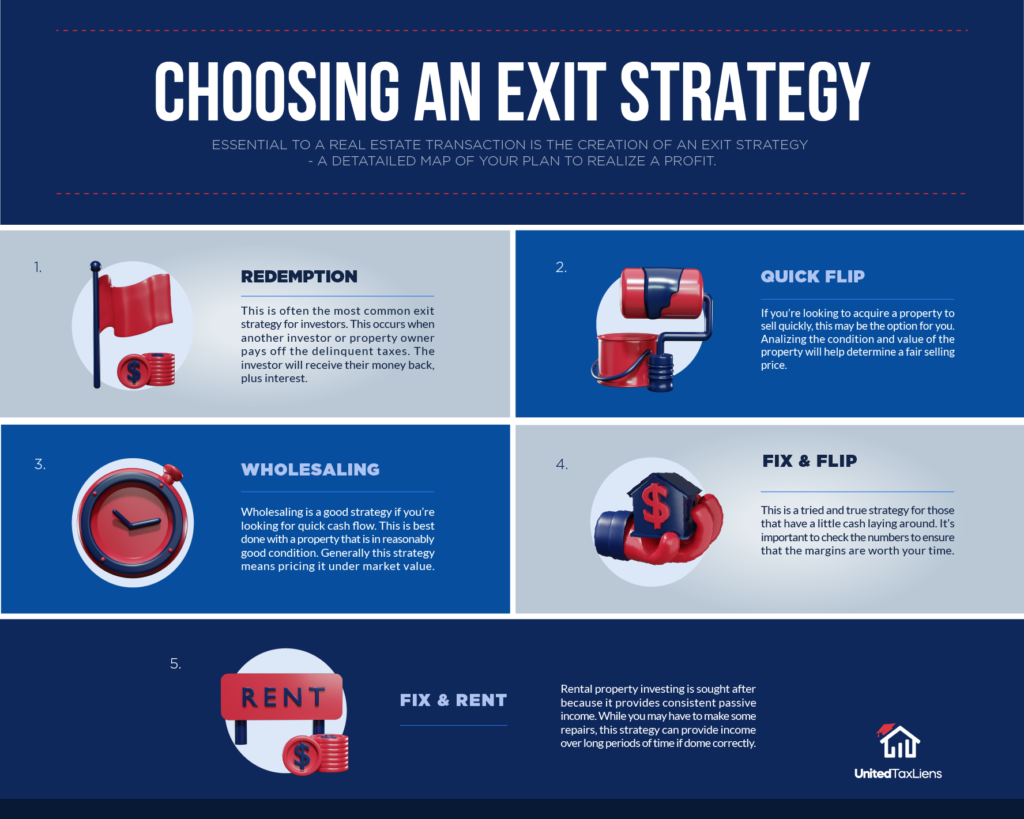

Some investors enter the world of tax lien certificates in the hopes of acquiring properties for far less than their market values. This is called active tax lien investing, and it can be facilitated in states where revenue collection agencies are legally allowed to auction off tax deeds. One such state is Florida, and this process's intent enables the highest bidder to initiate foreclosure right away. In a tax deed auction, the properties may have already gone through the tax lien certificate process more than once, and this will have to be settled by the highest bidder. You can turn an idle tax lien investing situation into an active position if you choose to initiate the foreclosure process at the first opportunity. Some investors negotiate with owners who do not wish to hold onto their properties any longer, thereby getting on the deed utilizing a legal transfer motivated by a cash payment. Investors who strike this kind of agreement with homeowners will have an easier time during foreclosure because objections would have been eliminated.

Most states typically operate under two forms of foreclosure: judicial or administrative foreclosure. Tax lien investors will have to go through either one of the processes if they hope to get their names on the property title. The aforementioned real estate seminar scammers will never tell you about foreclosures. You need to be aware of these legal proceedings because they may add to the property acquisition's final cost.

Judicial Tax Lien Foreclosure

Judicial foreclosure requires that the process is completed through the court system. If no litigation issues arise, investors should expect to pay between $2,500 and $3,500 in attorney fees. Suppose the homeowner decides to deploy a foreclosure defense strategy. In that case, court costs and legal fees will likely increase, and the same goes for third parties such as creditors, heirs, lien holders, and even gold diggers who may wish to claw at the property value.

In an administrative foreclosure state, the tax lien foreclosure is completed through the county government. The cost is decidedly less than in a judicial state and ranges between $500 to $1,000. While it might seem more beneficial to invest in an administrative state, there are pros and cons to both.

The main advantage of investing in a judicial state is that a licensed attorney typically handles each foreclosure. This means that the attorney is liable for any clerical mistakes. The attorney will typically include a service called “quiet title.” This document is considered crucial to a successful tax lien foreclosure. You will have the added assurance of a court decision backing your right to a clear property title.

Seasoned tax lien investors will tell you that judicial foreclosures are not as bad as some people claim. In the wake of the housing market crash of 2008, unethical mortgage borrowers took advantage of a broken court system in order to milk the judicial foreclosure process for as long as they could; however, this is no longer the case in many states because bar associations and court divisions worked together to enact corrective measures. In 2021, a foreclosure in Florida will go through a court process that is many times smoother than it was a decade ago.

Administrative Tax Lien Foreclosure

When investing in an administrative state, the investor pays the fees directly to the county. The county workers will be responsible for carrying out the process of the foreclosure. However, if mistakes arise from issues such as incorrect paperwork, the investor is responsible. Although it is cheaper to complete tax lien foreclosure in an administrative state, many investors prefer the judicial method since the attorney will submit the documents. Please note that this type of foreclosure is not wholly exempt from lawsuits. A disgruntled homeowner or someone who is named on the deed can file a civil complaint as the process is taking place. Even though a lawsuit will not necessarily stop the foreclosure process, it may create headaches in the future.

Smoothly completing the tax lien foreclosure process largely depends on your knowledge. It is essential to conduct due diligence and understand the laws of the state you're investing in. With all this in mind, many tax lien investors prefer to operate in judicial foreclosure states because law firms can ensure that their clients are able to get clear titles that are free from liens and encumbrances. This is known as a marketable title; what it means is that a prospective buyer can order a title search and get peace of mind from knowing that they are looking at a free and clear property. If the buyer needs to finance the purchase through a mortgage loan, the bank will also get a clear opinion of title and even insurance from a title indemnity company.

Success in tax lien investing starts with identifying the right opportunities. Marketplace Pro is the only software solution that gives you actionable information about properties you can bid on a tax lien certificate and deed auctions.

Get in touch with our office today and schedule a demonstration of Marketplace Pro.