A business plan is not complete unless it has a fully dedicated section to outlining an exit strategy. Banks will not grant commercial loans to new business ventures unless you can formulate a solid exit strategy. Let's say a retail entrepreneur wants to start an e-commerce website. For the bank to consider lending startup funds, the entrepreneur must explain how she intends to either liquidate the business, transfer it to someone else, or sell the entire company when the operation comes to an end. The bank wants to see an exit strategy conducive to loan repayment, but the entrepreneur would like to profit when exiting the business.

In the case of real estate investing and the pursuit of tax lien certificates and deeds at county auctions and sheriff's sales, exit strategies are not limited to the overall business enterprise but also each investment made. Suppose you are writing a business plan to attract potential investors or commercial financing. In that case, you have to include both the overall exit strategy in addition to the five systems we will discuss below.

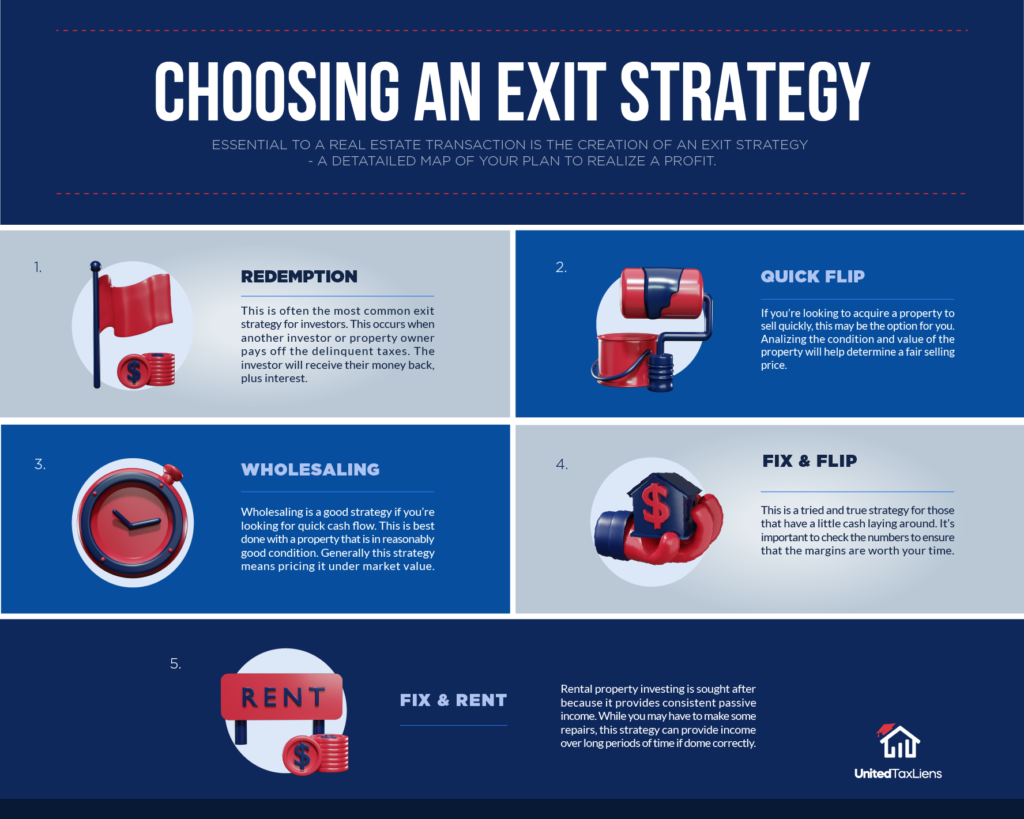

Developing an exit strategy is a crucial component to formulating a solid tax lien investment plan. Having a formal process will undoubtedly save you valuable time and money. An exit strategy is how you intend to realize a profit from each particular investment, which will begin when you come away as the highest bidder at an auction. You need to understand each strategy to determine which one will work out better for every deal. You will have to research the value of the property and its type and potential to settle on an exit strategy that makes sense.

You must always keep in mind that an exit strategy is required for every deal, and you have to approach it as the way you will be generating a profit. You will find that some of the exit strategies used by tax lien investors are very similar to those applied by house flippers.

The Five Most Common Exit Strategies for Tax Lien Investors

- Redemption

- Quick Flip

- Wholesaling

- Fix and Flip

- Fix & Rent

1. Redemption

This is usually the most popular exit strategy for tax lien investors. This happens when another investor or the property owner pays off the delinquent taxes. The investor will receive their money back plus interest. Interest rates are determined by each state and may vary.

State law and county rules will determine the manner of repayment as well as the term. Some homeowners will want to set up an installment plan, while others will opt for a lump sum or a couple of payments to be made within the term, which can last up to three years. Should the owner of the land or home decide to sell the property in the meantime, the closing agent will arrange for the tax lien to be satisfied using the transaction proceeds. Once the certificate is redeemed, the satisfaction of the lien is recorded, which means that it will go away; you would have collected an excellent rate of interest, and the transaction will serve as a notch in your investor's belt.

2. Quick Flip

Selling the property to another investor may be an option for you. You'll need to evaluate the condition of the property once again and determine a reasonable sale price. Many investors specialize in flipping real estate, so pricing the property to sell will work in your favor. In this case, building a network would mean you could already have a potential buyer in mind. This makes for an even quicker and easier transaction.

This exit strategy is similar to what you see in reality television shows that focus on house flippers' work, but it foregoes improvement of the property. Flipping for quick profit is often contingent upon housing market conditions. In a hot seller's market where the housing supply is low, quick flips are more comfortable since buyers are continually looking to become flippers themselves. Please note that this strategy assumes that you have somehow taken possession of the property, and you can clear other liens.

3. Wholesaling

Wholesaling is a good strategy if you're looking for quick cash flow because you can sell the contract to another investor. If you're not against doing minor rehab work or if you acquire a property in good condition, this is a great option. With this method, you can sell it under market value to speed up the selling process.

The potential profit you can generate with wholesaling is generally less than other exit strategies because you only sell the contract. Potential buyers will not necessarily occupy the property; they may be real estate professionals, investors, or speculators who are wholesalers themselves. Some people would argue that you would better off acting as a real estate broker, but this requires licensing and registration with a state regulator.

4. Fix and Flip

If you have some extra cash and are looking for a property to fix up, this tried and true strategy is perfect for you. Before choosing this option, it's crucial to check the numbers to ensure that the margins are worth your time. For instance, if you acquire a $30K property worth $50K and needs $15K in repairs, this may not be the most profitable strategy.

Tax lien investors should not assume that all the properties that fall into certificate auction status are in disrepair. In some cases, the homeowners fell behind on paying taxes, and they would most likely want to keep their properties. Some investors can negotiate with the homeowners to walk away from the property if it is falling apart. A few thousand dollars and a recorded agreement may allow you to file foreclosure in an uncontested manner so that you can take possession and proceed to improve the property.

If you are a licensed realtor, you can simultaneously act as a tax lien investor and as a house flipper. You will need some capital to pay for the remodeling projects, and you will also need to list the property; however, acting as your real estate broker means keeping all fees to yourself.

5. Fix and Rent

Rental property investing is often a common goal among real estate investors because it provides constant passive income. Like fix and flips, renovations are often required. The key to completing a successful rental property deal is making sure you understand the market. While it's helpful to know that the margins are solid, knowing what other renters are paying in the area can help determine your returns. Doing this will help predict how long it will take to make back the money you invested.

For example, if you acquire a property for $30k and spend about $10k in repairs, that's $40k spent in total. If a similar property in the area rents for $1,500 per month, it will take a little over two years to break even. After that, the rental property would be a steady cash flow.

Of all the exit strategies, becoming a landlord is one that will require work, dedication, and patience. It can be very profitable in San Francisco markets, where a one-bedroom apartment could easily rent for $2,800 in late 2020. This is a commitment to entering leasing contracts and watching market conditions to decide whether you wish to keep renting or listing the property for sale.

Overall, Choose an Exit Strategy Based on Research

Choosing an exit strategy doesn't have to be complicated, but you do have to do your due diligence. Understanding your market and analyzing the margins will help you make an educated decision. It is hard to predict if you will be redeemed or if you'll acquire the property, but creating an exit strategy beforehand can save you from making mistakes.

Another exit strategy that was not discussed above is not entirely business-related. It involves falling in love with the property that you hold a tax lien certificate for. This could be a home in a lovely part of town that needs a certain level of repair and maintenance to make it attractive to the point that you will want to keep it for yourself. This situation is not unheard of among investors who participate in deed auctions, which means that they can walk away from the courthouse steps with title to the property.

A great deal of the success you can derive from tax lien investing has to do with locating diamonds in the rough. With Marketplace Pro software, you can quickly and easily identify properties offered in county auctions. Learn more about Marketplace Pro by contacting us today and scheduling a demonstration.