Vacant land is one of the most overlooked and misunderstood real estate investments out there. Many people shy away from vacant land because they don’t understand the benefits of the investment.

Pros to Investing in Vacant Land:

- No Tenants

- Motivated Sellers

- Easy to Invest Remotely

- Fewer Expenses

- Establish the Highest and Best Use

- Direct Ownership and Peace of Mind

- Affordability

- Less Competition

- Multiple Ways to Make Money

- Land is a Limited Resource

What is Physically Possible? – What could realistically be built upon the land in question? To answer this question, you’ll want to have a thorough site survey performed. The land’s terrain, for example, could preclude certain types of improvements. Its proximity to easements and utilities may also affect what can be built upon it.

What is Legally Permitted? – Regardless of where the vacant land is located, it is subject to whatever zoning restrictions have been placed upon it. However, you may be able to appeal to the local planning board to have the zoning changed. That’s something that may be worth investigating, and it should be done to ensure that you arrive at the best and most profitable use of the land.

What is Financially Feasible? – If you have a proposed use in mind for the land, you also need to determine if it’s financially feasible. In other words, would your proposed improvement generate enough income to justify developing the land in the first place? To get to the bottom of this, in-depth financial analyses are needed.

What is the Most Productive Usage? – Finally, you take the above factors together to decide the most productive, or profitable, use of the land. Ideally, you’ll come up with a list of several options, and then you can rank them from highest to lowest.

Direct Ownership and Peace of Mind

You Can Establish the Highest and Best Use: Vacant land is like a blank canvas. Many times, there’s a variety of ways to put it to practical and profitable use. When you invest in vacant land, you gain the opportunity to establish its highest and best use. You can be as creative as you’d like since no one has developed the land before, and there are no improvements involved.Land is a Limited Resource

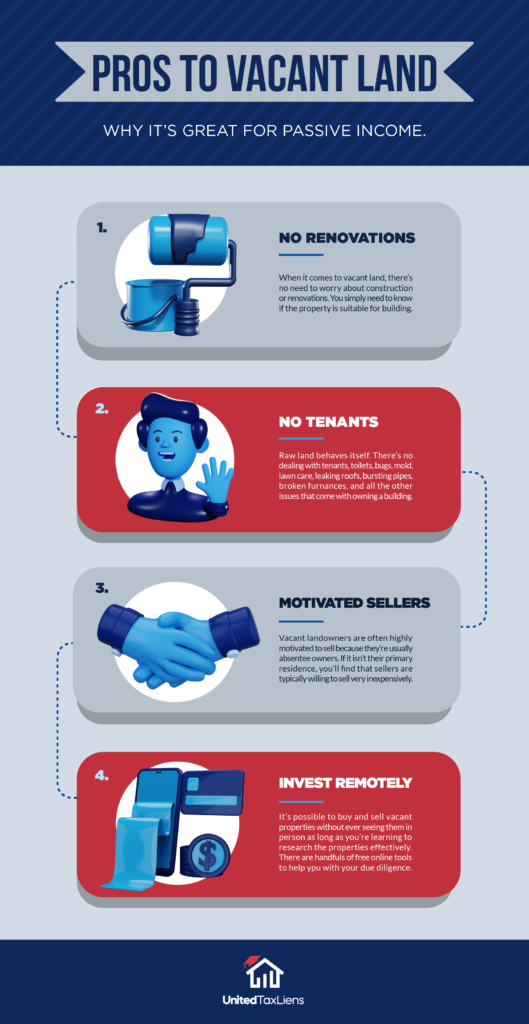

When it comes to vacant land, there’s no need to worry about construction or renovations. You need to know if the property is suitable for building. As long as another party can build on the land, this now opens up opportunities for someone else to build on the land if/when they want to.

No Tenants: Raw land behaves itself. There’s no dealing with tenants, toilets, bugs, mold, lawn care, leaking roofs, bursting pipes, broken furnaces, and all the other issues that come with owning a building.

People Are Motivated to Sell: Vacant landowners are often highly motivated to sell because they’re usually absentee owners. When a person doesn’t live inside or even near the vacant property that they’re trying to sell, there’s less emotional connection. If it isn’t their primary residence, you’ll find sellers are typically willing to sell very inexpensively.

Easy to Invest Remotely: It’s also easy to buy and sell vacant properties without having to see them in person as long as you’re learning to research the properties effectively. Everything is done virtually in this day and age. There are handfuls of free online tools to help you with your due diligence. For example, Zillow or Trulia can help you find the information you need.

There are Fewer Expenses: When you’re buying vacant land for a low price, there is no mortgage payment requirement. There are no utility bills to pay, and the cost of property insurance (if you have it at all) is minimal. If you’re an investor looking to park your money somewhere and forget about it, vacant land could be exactly the investment opportunity you’re looking for.

When determining the highest and best use for a parcel of vacant land, consider these four factors:

Ultimately, you may find that the highest and best use for the land aligns with something that is in high demand in the local area. For example, you might develop the land into office space; if office vacancy rates are low, you could make serious money on the ground down the line.

Since you will likely purchase the land outright with cash, you won’t have to worry about the ongoing costs of a mortgage. There won’t be any interest fees, loan origination fees, or other expenses to worry about. At the same time, you have acquired a tangible asset with its own value – one that is likely to appreciate over time, allowing you to enjoy a tidy profit down the line.

Affordability

Investing in raw land is an affordable way to diversify an investment portfolio. The upfront costs involved are minimal, so you can get started quickly. In fact, it’s an excellent way for someone interested in real estate investing to get their foot in the door with minimal risk. Ideally, save up some cash so you can buy some vacant land outright. Down the line, you may be able to offer seller financing to future buyers, tapping into another potential income stream.

Less Competition

If you have been involved in real estate investing to any extent, you already know how much competition there tends to be for the most promising income-producing properties. If you’re tired of dealing with bidding wars and other headaches while acquiring properties, vacant land is something to consider. Since there are no improvements on such land, it doesn’t attract nearly as much interest from investors. That’s because there’s no immediate way to earn money from such properties, of course, but there are plenty of ways to do so over the long haul.

As long as you have perseverance, patience, and fortitude, investing in vacant land can be surprisingly easy. The lack of competition lets you take your time when considering a property, allowing you to determine whether or not it’s worth your while.

Multiple Ways to Make money

As noted above, investors often turn up their noses at vacant land because they can’t start generating income from it right away under most circumstances. Unimproved land doesn’t tend to appreciate as quickly as improved land, either, which also gives many investors pause.

Still, there are plenty of ways to generate profit from an investment in vacant land. Buying and holding the land is a good option, but you must be prepared to stick with it for the long term. That’s because it can take several decades for land to appreciate to the point that it’s worth your while financially to sell it. Always consider the potential near-future use of any vacant land that you view. If it’s on the outskirts of a growing area, its value could shoot up more quickly than you expect.

A faster way to potentially realize income from vacant land is by leasing it out. Farmers may be willing to lease the land from you for growing their crops. Note, however, that farmland tends to be more expensive than “regular” vacant land. Also, land is often left vacant for good reasons – and being unable to grow anything on it is considered one. You may also be able to lease the land to hunters, but restrictions typically apply.

Finally, you may be able to offer seller financing to potential buyers in the future. Most banks won’t make loans to purchase vacant land, so offering to finance yourself could make the land more attractive. You’ll be able to collect interest income in this case, which will add to your bottom line.

Land is a Limited Resource

One last thing to consider is that land is truly a limited resource. You can’t make more of it, so snapping it up where and when you can often is a good strategy. Of course, vacant land is more precious in some places than in others, so it’s wise to be strategic when buying vacant land for investment purposes. Perform some research to determine how much vacant land is available in the surrounding area. If there’s not much of it to go around, it could increase in value pretty quickly. Remember that if you don’t buy the land, another investor probably will. Could you be handing over considerable future profits to someone else?

Raw land is a long-term investment. It should give you peace of mind knowing it’s a tangible asset that doesn’t wear out. It doesn’t depreciate, and nothing can be broken, stolen, or destroyed. You can always unload the property by wholesaling, getting in contact with real estate agents, or developing the land. As a result, you’d add substantial value to the property.

Don’t Knock It Until You Try It! It’s an unfortunate misconception that vacant land is a bad investment. Vacant land can produce some serious passive income and can be great for many investors because of its hands-off nature and versatility.