One of the unique advantages of real estate investing is the tax benefit it offers. This benefit is primarily due to the concept of depreciation.

Depreciation and Taxes

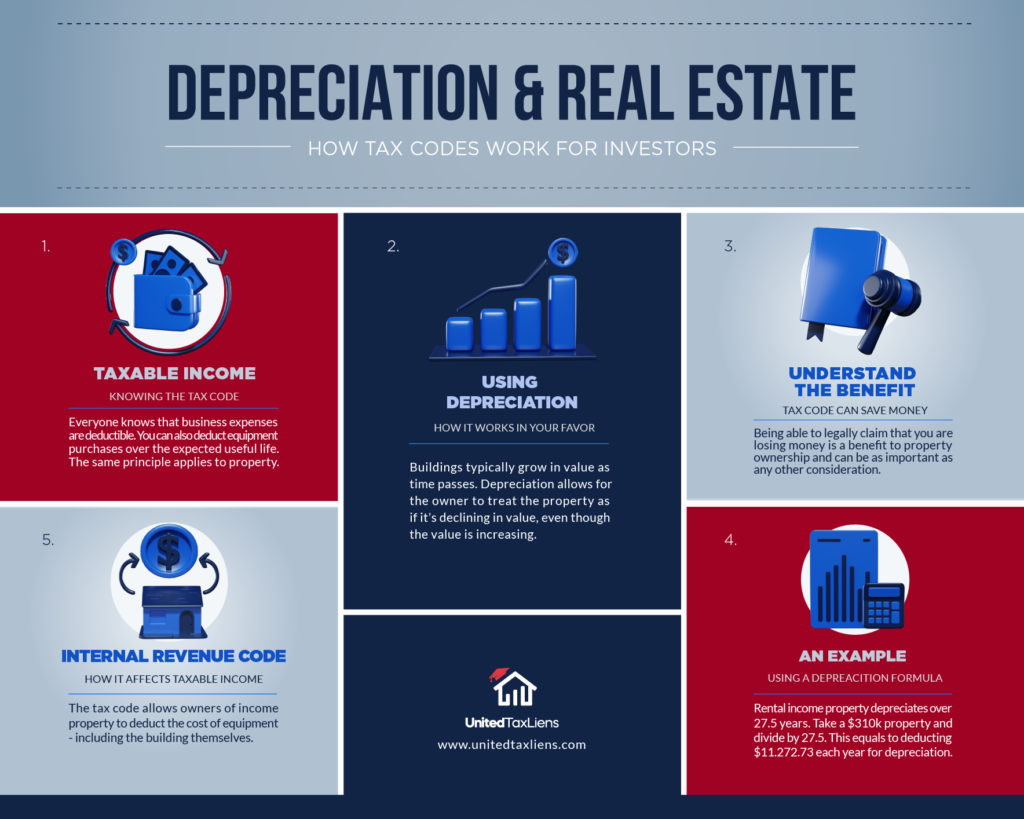

Most people recognize that business expenses are deductible. Labor, cost of goods sold, and equipment purchases are all expenses that reduce a typical business's taxable income. In the case of equipment purchases, they must typically be deducted from income over the expected useful life of the equipment purchased. Depreciation occurs by removing an expense over time.

For example, a construction company purchases machinery for $80,000 that has an expected life of 10 years. Rather than deducing the full amount, the Internal Revenue Code (IRC) allows the company to write off $8,000 per year for 10 years. It recognizes the depreciation in the value of the machinery.

Similarly, the tax code allows owners of income property to deduct the cost of any equipment they purchase – including the cost of the buildings themselves. But unlike most equipment, which really does wear out and loses value over time, buildings typically grow in value as time passes. Unlike other costs associated with operating a property (i.e. taxes, insurance, maintenance, etc.), which are actual, out-of-pocket expenses for a landlord, depreciation is a deduction that does not reflect a real cost to the owner. In other words, this depreciation deduction essentially allows the owner to treat the property as though it were declining in value. You can do this even as the property steadily increases in value. Let's see how this might work with an actual income property investment.

How Depreciation Works Over Time

Suppose you purchase a 4-plex for $380,000, with a monthly cash flow of $500. When you calculate your tax obligation for the year, determine how much of the building's cost was in the land's value. Buildings could depreciate, but land cannot. Let's say that you allocate $70,000 to the cost of the land. The remaining $310,000 is allocated to the cost of the building.

Residential income property depreciates over 27 ½ years. So, we would divide $310,000 by 27.5. With this formula, we find that we can take a deduction of $11,272.73 each year for depreciation. Remember, we had a positive cash flow of $500 per month after operating expenses and debt service. That is $6,000 per year. However, after the $11,272.73 deduction allowed for depreciation, the entire cash flow of $6,000 would be offset. This means no tax liability incurs. The property would be showing a “paper loss” of $5,272.73 for the year. In other words, the $6,000 you made from your property was tax-free!

Furthermore, you could have a loss to use as an offset to other income you may have earned during the year. Being able to claim that you are losing money, legally, is a benefit to real estate ownership. Understanding depreciation can be as significant as any other consideration.

Requirements for Depreciating Rental Properties

To realize the considerable benefits of depreciating a rental property, ensure that your situation applies. You can depreciate a rental property for tax purposes if the following are true:

- You own the property; you are considered the owner even if you hold a mortgage on it.

- You use the property as part of your business or as an income-producing activity.

- The property has an effective life that can be determined for calculation purposes.

- The property is expected to last for at least one year.

An important caveat: If you place a rental property into service and discontinue it within the same year, you cannot depreciate it. Additionally, you can only depreciate the cost of the buildings, or improvements; since it can't be “used up,” land cannot be depreciated. Likewise, you can't depreciate the costs of landscaping, clearing, or otherwise altering the land.

When Can You Start Taking Depreciation Deductions?

You can begin taking depreciation deductions on a rental property as soon as it is ready and available for use as a rental. In other words, if you buy a property in April, work on it in May, list it for rent in June and fill the vacancy in July, you can start taking the depreciation deduction in June – when it became available.

Once you've deducted the entire cost of the property, you must stop taking the depreciation deduction. If you take the property out of service, you must stop deducting depreciation – even if you haven't recouped the full amount.

The Basics of Calculating a Depreciation Deduction for a Rental Property

To calculate the depreciation deduction for your rental property, you'll need to know three things: your basis in the property, the recovery period, and the depreciation method to be used. Any residential rental property placed into service after 1986 must be depreciated using the Modified Accelerated Cost Recovery System, or MACRS. This technique spreads the costs and depreciation deductions over the property's useful life of 27.5 years.

- Figure Out the Basis of the Property – First, determine the rental property basis, which is the total amount you paid. In addition to the property's cost, the basis may include certain closing costs and settlement fees, including legal fees, transfer fees, recording fees, and title insurance. It may also include any other expenses owed by the seller, such as back taxes.

- Determine the Cost of the Land and the Improvements – Since you can't depreciate the value of land. It would help if you separated the cost of the land from the cost of the improvements. You can use the fair market value of each at the time of purchase or use the assessed real estate tax value.

- Determine Your Basis in the house versus the Land – Using the information from the previous step, calculate your basis in the house. If you bought the property for $150,000, and the assessment says the property is worth $100,000 — $80,000, or 80 percent, for the improvements and $20,000, or 20 percent, for the land — your basis for the house would be $120,000 ($150,000 x 0.80).

- Calculate the Adjusted Basis – You may need to adjust the basis you arrive at in some cases. Increases to the basis prior to service may arise from improvements or additions, certain legal fees and restoring damage to the property. Decreases may occur from insurance payments for theft or damage to the property or money obtained for granting an easement, for example.

GDS vs. ADS

Next, determine which depreciation method to use. The vast majority of the time, you will use the General Depreciation System, or GDS. In some instances, you may have to use the Alternative Depreciation System, or ADS. ADS may be required if you irrevocably elect to use it or if it's mandated by law. Instances in which it's required by law include if the property has a tax-exempt use, if it is financed using tax-exempt bonds, if its primary use is for farming or if it has a qualified business use 50 percent or less of the time.

Once you know which method you're using, you can figure out the recovery period. GDS sets the recovery period for residential rental properties at 27.5 years. For ADS, the recovery period is 30 years if put into service on or after December 31, 2017, and 40 years if put into service before that.

How Much Depreciation Can You Deduct Per Year?

With depreciation deductions, you can spread out the cost of purchasing a property over decades, which allows you to reduce your tax bill every year for many years. A property depreciates by an equal amount per year – a rate of 3.636%. If it was put into service later in the year, the amount is less for that year. You can get the exact percentage by checking the IRS Residential Rental Property GDS table. Note that this rate is essentially equivalent to dividing the basis by 27.5.

How does this help to save you money? You report rental income and expenses on Schedule E; the net gain or loss from that then goes over to your 1040 return. Depreciation deductions are applied on Schedule E, so they can reduce your taxable income. For instance, if you depreciate $4,122.65 and are in the 22% tax bracket, you can save $906.98 on your tax bill for that year through this method. Needless to say, this can really add up over time.

Make the Most of Real Estate Investing with Depreciation Deductions

As you can see, deducting depreciation from a rental property is a terrific way to reduce your overall tax liability. In some cases, it can even wholly offset any taxes that you may owe on the property, allowing you to pocket even more of your hard-earned money. To make the most of this technique, make sure to consult with a qualified tax accountant before getting started.